Outplacement Services Near Me: A Comprehensive Guide for Employers and EmployeesIf you've recently lost your job or are an employer needing to lay off employees, you might have heard about outplacement services. But what exactly are outplacement services, and how can they benefit you? In this post, we'll take a closer look at outplacement services, how they work, and why they're essential for both employers and employees. What are Outplacement Services?Outplacement services are a type of career transition service designed to help employees who have been laid off or terminated find new employment. These services are typically provided by third-party companies that specialize in job search assistance, resume writing, interview coaching, and career counseling. The goal of outplacement services is to help employees find new jobs as quickly as possible and make the transition from one job to the next as smooth as possible. How Outplacement Services WorkIf your employer offers outplacement services, you'll typically be given access to a variety of resources and tools to help you find a new job. These might include job search websites, resume writing services, career coaching, and job search workshops. Your outplacement provider will work with you to create a personalized job search plan tailored to your skills, experience, and career goals. If you're an employer, you'll typically work with an outplacement provider to create a customized program for your employees. Your provider will work with your employees to help them navigate the job market and find new employment opportunities. This can include one-on-one career coaching, group workshops, resume writing services, and job search tools. Benefits of Outplacement Services for EmployeesIf you've been laid off or terminated, outplacement services can be an invaluable resource. Here are just a few of the benefits you can expect:

Benefits of Outplacement Services for EmployersIf you're an employer, offering outplacement services can benefit both your company and your employees. Here are just a few of the benefits:

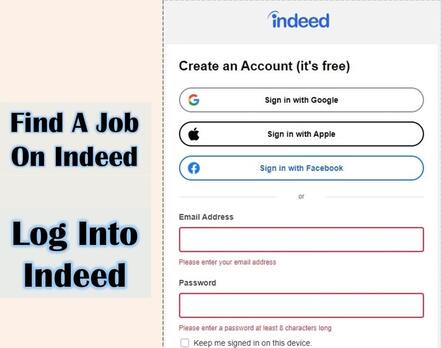

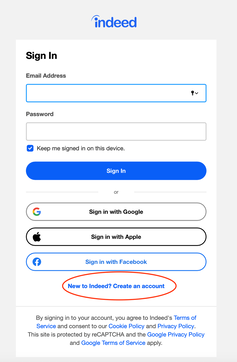

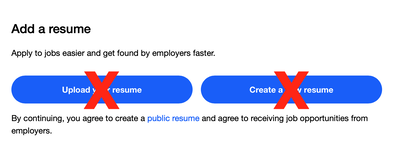

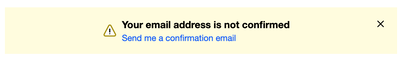

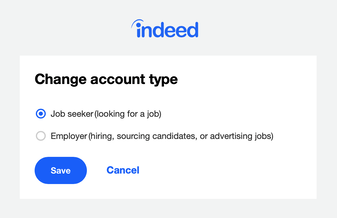

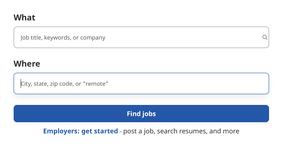

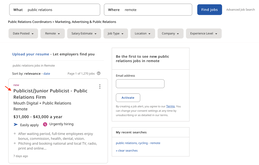

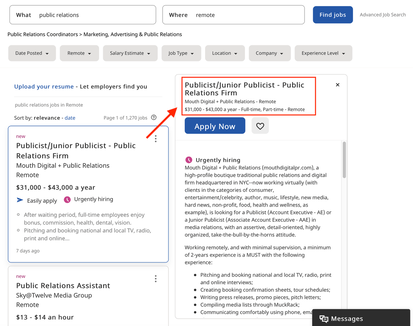

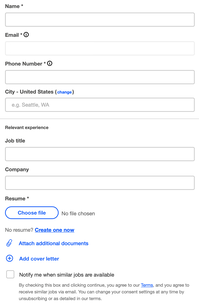

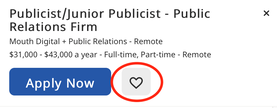

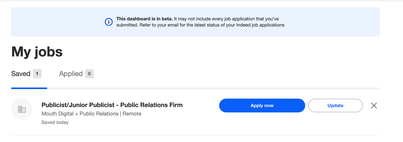

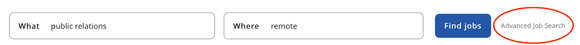

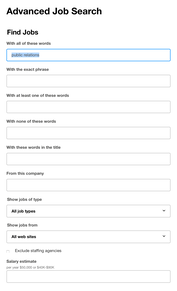

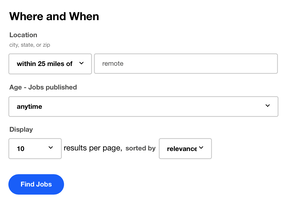

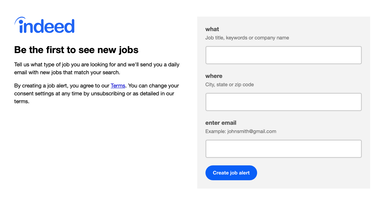

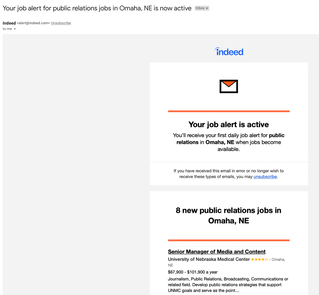

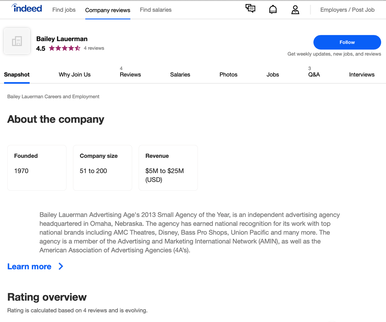

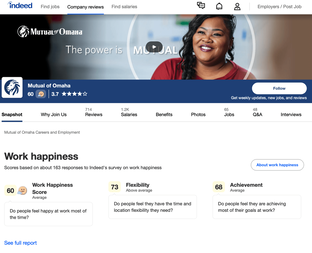

Outplacement Services Near MeIf you're looking for outplacement services near you, there are a few things to keep in mind. First, make sure to do your research and find an outplacement provider who has experience working with employees in your industry. You'll also want to look for providers who offer a range of services, including resume package deals, professional LinkedIn profile writing , job interview coaching, career coaching, and other related services. One Outplacement Call can resolve many complications. You can start your search for outplacement services near you by doing a quick online search. Use keywords like "outplacement services near me" or "career transition services near me" to find local providers. You can also check with your HR Department to see if they have any recommendations. ConclusionOutplacement services can provide support for both employers and employees during a layoff or termination. These services can help employers to manage the process of letting employees go, while still showing support and compassion for their staff. For employees, outplacement services can provide practical and emotional support during a difficult time, helping them to find new employment and cope with the stress of a job loss. By offering outplacement services, employers can protect their reputation, support their employees, and help ease the transition into new employment. About the AuthorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. How To Find A Job On IndeedIndeed bills itself as “the #1 job site in the world.” Indeed is more than a job search board. It’s a tool you can use in your job search. It can be especially valuable in a passive job search, delivering job opportunities to your email each day. The first step is to create an Indeed account. It’s free, and setting it up will take just a few minutes. On the Indeed.com home page, click the “Sign In” link. That will take you to a login screen. On that page, click “New to Indeed? Create an account.” You’ll be prompted to “Add a resume.” Don’t do it. Do not upload your resume to your Indeed profile. Instead, customize your resume for the specific position you’re applying for. You can still use the “easy apply” option available on job postings by uploading a specific resume for a specific job. You’ll get a better match with applicant tracking systems if you tailor the resume for the job posting. In addition, if you upload a resume, your resume is public by default and may be viewed by anyone accessing the website. Indeed’s terms and conditions page says “this includes users of Indeed’s Resume Search product, Employers whose Company Page you may be following, and anyone with access to the URL associated with your public resume, such as search engines and other third parties that may crawl our Site. We offer you this visibility to help you find a job.” If you’re conducting a confidential job search, posting your resume may tip off your employer that you’re looking for a new role. That’s another good reason not to upload a resume. After continuing on, you’ll be prompted to confirm your email account. Click on the link and you’ll receive an email with a button you’ll need to click to complete the confirmation: And once you click on the link, you’ll get a confirmation message: You should also designate your account type: Click the “Set account type” button. Choose “Job seeker (looking for a job).” Once your account is set up, you can save jobs that you want to apply for so you can come back to them later. Once you’ve applied, you can also track your status for positions you’ve applied for on the same page. Use Indeed Search to Identify Possible MatchesIndeed’s search function is robust. You can search for possible job opportunities by location, distance, industry, job title, experience level, salary, and more. You can use Indeed’s filters to refine your search parameters, adding or removing criteria until you find positions that are a good fit for your skills, education, and experience. To get started using Indeed search, click on the “Find jobs” link in the menu bar. The default search is “What” (job title, keywords, or company) and “Where” (city, state, zip code, or “remote”). Indeed will identify job opportunities that match the criteria you’ve selected. Click on the job title to expand the information about the posting. Click on the “Easily apply” link or the “Apply Now” button to apply for the role. A new window will open. Enter your information in the fields. You can also attach your resume and cover letter. Or click on the “heart” button next to the “Apply Now” button to save the posting for later. (It will be saved to the “My Jobs” page.) Here is the saved job dashboard: Indeed Advanced Job SearchIndeed’s Advanced Job Search function makes it even easier to target job opportunities. With the search function, you have the option to see jobs from job boards only, from the websites of employers only, or both. You can also include or leave out postings from staffing agencies. You can target specific salary ranges using the salary estimate field. You can choose specific location and distance criteria, and choose to see jobs posted only within a specific number of days. In addition to searching for job postings, you can set up job alerts to be emailed to you. Setting Up Job Alerts on IndeedJob alerts are emails listing new jobs posted on Indeed that meet the criteria you’ve established. Instead of visiting Indeed daily to see what opportunities are available, you can receive an email with postings. You can choose to have alerts sent to you daily or weekly. Set up Job Alerts on this page: https://subscriptions.indeed.com/create/jobaler Once you enter your information, you’ll see a confirmation screen: You’ll also receive a confirmation email to the email address you entered, along with jobs that match the criteria you selected. Indeed also offers plugins for Chrome, Firefox, and Google Toolbar. These apps provide notifications from within your Internet browser about new jobs and messages from prospective employers. Use Indeed for ResearchIndeed provides Company Pages, providing reviews of the workplace, photos, job openings, and salary data. On the job posting, click on the company name to access this information. If a Company Page is available, it will open when the company name is clicked on. On the Company Page, you can see a Snapshot of the company. The company can populate a “Why Join Us” page and photos. You can read employee reviews of the company, and look at a list of all the jobs posted on Indeed. There is also salary and benefit information. Jobseekers can post questions that a company representative or other people can answer. Some Company Pages are more complete than others. Salary and benefit information is user-submitted, so the more employees the company has, the more likely this information is to be populated on the page. Indeed also conducts surveys on work happiness. It evaluates several criteria:

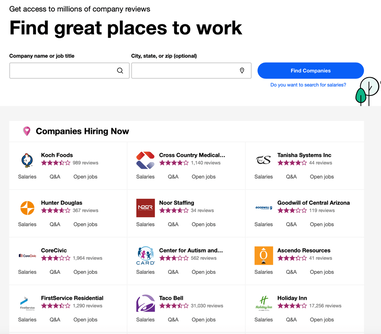

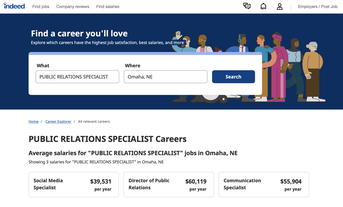

The Work Happiness section will tell you how many people completed the work happiness survey, so you can see the sample size the scores are based on. You can also click on the “Company reviews” tab in the menu bar and identify companies that are hiring. Simply enter your city or state and you can see the “popular companies” in that city and state. The listings also include links to reviews, salary information, and jobs. Using Indeed for Salary ResearchIndeed can also be a useful resource for salary information. In addition to company-specific salary data (found on the Company Page), you can use the “Find salaries” function on the menu to generate salary information. While not as robust as information on a specialized salary research site like Salary.com, you can generate some ballpark numbers based on job titles and location. Indeed is a robust tool for your job search toolbox. For active jobseekers, you can search the site for opportunities, drilling down your criteria to very specific parameters. For passive jobseekers, set up alerts and let Indeed serve up openings via email. You can also search for Indeed job be clicking here before you log into Indeed.

The Cost of Unemployment

Have you ever stopped to consider the cost of being unemployed? The longer you are out of work, the more costly it is. Here are some things you may — or may not — have considered as the “cost of unemployment.”

Lost Wages

Loss of income is the most obvious cost of unemployment. Unemployment benefits – if you’re eligible for them — only cover a portion of your lost income. According to research by Newsweek, basic unemployment benefits average $300-$400 a week, typically covering 45 percent of a worker’s income. Severance pay, if offered, can help, but a long period of unemployment can outlast that as well.

Cost of Insurance

According to the 2019 Census, 55 percent of Americans have employer-paid health insurance. Research from the Kaiser Family Foundation found the average annual single premium per enrolled employee for employer-based health insurance was $6,972 per year in 2019, with the employee contributing $1,489 of that, and the employer paying $5,483.

While the Consolidated Omnibus Budget Reconciliation Act (COBRA) health insurance program allows eligible employees and their dependents to continue their health insurance coverage for 18 to 36 months after a job loss, the entire cost of the premiums is the responsibility of the individual. Based on the average, that means you would be responsible for paying almost $600 a month in health insurance premiums to keep your existing coverage. If COBRA coverage is not available, individuals can obtain insurance through the government’s Healthcare Marketplace, but that coverage can be expensive. A short-term health insurance policy may be more affordable, but may have a higher deductible and limited coverage. Going without healthcare insurance is risky financially. Medical bills are reported to be the number one cause of U.S. bankruptcies, and being uninsured can lead to significant out-of-pocket expenses. Lost Retirement Contributions

If you were contributing to your company’s retirement plan — especially if your contributions were matched by your employer — consider the financial impact of missing out on adding to your retirement savings. Every $500 missed could be worth up to $1,300 (assuming 5 percent growth over a 20-year period). Missing out on six months’ worth of retirement contributions could equal almost $8,000 in lost retirement income.

Increased Stress and Anxiety

According to CNBC, 63 percent of households report living paycheck to paycheck, meaning the loss of even one month’s salary could cause severe financial insecurity. Eight in 10 people say they currently can’t cover a $500 emergency. Research also shows that unemployment is linked to anxiety and depression, among other negative outcomes.

Negative Impact on Future Salary

When you’re unemployed, you may take a lower-paying job while negotiating your salary, just to get back into the job market. However, don't forget to think about the day when you may need to have a conversation about getting the raise you deserve. Since future raises are based on your new (lower) starting salary, you may find yourself missing out on tens of thousands of dollars of future income.

For example, if your original salary was $50,000, and you received annual raises of 3 percent, after 5 years, your salary will be $56,275. If you took a job that paid $45,000 and you received annual raises of 3 percent, after 5 years, your salary will be $50,647 — barely what you were making when you left your previous position. You would have also missed out on $26,544 in pay during those five years ($265,453 from the starting salary at $50,000 plus 3 percent raises minus $238,909 – five years of salary starting at $45,000 with a 3 percent annual increase). You may also make poor financial decisions out of desperation. For example, you might cash out your 401(k) fund to free up some cash to cover your living expenses. However, with limited exceptions, if you withdraw money from your 401(k) retirement account before the age of 59-1/2, you will pay a 10% early withdrawal penalty, plus income tax, on the distribution. For someone in the 24 percent tax bracket, an early withdrawal of $5,000 will cost $1,700 in taxes and penalties. In addition, you’ll lose out on the future growth of that $5,000. Invested for 20 years at 5 percent, that $5,000 would have grown to more than $13,000. The best thing you can do if you find yourself unemployed is to get back to work quickly:

How To Prepare For Unemployment

First — and most important — keep your résumé up-to-date and ready to go. Not only is it easier to pay for résumé services when you’re employed, but you won’t lose valuable time getting started with your job search. It can take anywhere from a few days to a few weeks to create an interview-winning résumé and portfolio of career documents. The sooner you are able to start your job search, the closer you’ll be to going back to work. Also, the longer you are unemployed, the harder it is to find a new job.

Second, have an emergency fund. One of the biggest struggles with unemployment is losing your income. Unemployment benefits — if you’re eligible to receive them — can take weeks to get approved. In the meantime, having an emergency fund — even a small fund of 2-4 weeks of expenses — is better than nothing. Most experts recommend having 3-5 months of savings. Third, the best offense is a good defense. If you think you’re in danger of losing your job, batten down the hatches. Make a list of your current expenses (review your checkbook register, credit card statements, or online banking profile) and see what you can cut out. You may have to prepare for a financial apocalypse. Determine which of your current monthly expenses must be maintained (mortgage and car payments, utilities, groceries) and which ones you can do without for now. Eliminate any unnecessary expenses. Finally, it can be easier to find a job when you have a job, so don’t wait until you lose your job to start looking. And take the advice of author Harvey Mackay and “Dig Your Well Before You’re Thirsty” and cultivate your network while you’re still working. Learn how to use LinkedIn. Get a FREE LINKINEDIN SCORECARD. Review your professional and personal connections and try to revive your network . After all, the cost of unemployment is high. Higher than you may have thought.

Applying for unemployment benefitsA guide to apply for unemployment insurance

If you recently lost your job, you could qualify for unemployment benefits. Keep in mind that you cannot apply for unemployment benefits if you quit your job or were fired for negligence or misconduct. If this is the case and you feel you were fired unfairly, your best option is to contact a wrongful termination attorney.

Unemployment is meant to be a temporary form of assistance that replaces a part of the salary you’re no longer earning. These benefits are managed at state levels, but federal guidelines exist. The complete name of this program is the Federal-State Unemployment Insurance Program. Since these benefits are funded through taxes paid by employers to states, the amount of the benefits, requirements, and duration vary from one state to another. There are two main requirements you have to meet before filing: 1. You need to have worked for a specific time period. Most states require you to work for a full quarter before you become eligible for unemployment benefits. 2. You need to have lost the job through no fault of your own. These criteria vary from one state to another. It’s important to start filing for unemployment as quickly as possible, since you’ll have to wait a few weeks before you start receiving benefits. Some states actually require you to wait an entire week after losing your job before beginning the filing process.

Follow these steps to apply for unemployment benefits:

Most states will grant you unemployment benefits for 26 weeks. Your state can also provide you with valuable resources. You might be required to register through the State Employment Service to be matched with open positions in your area. If your state doesn’t require you to register through this service to receive benefits, it could help you to register anyway so you can be alerted about available positions. Other resources include testing, counseling, and training programs. These are options you should explore if you have a hard time with finding work in your field. There is a variety of tutorials and training content available online. For example, Microsoft Office offers FREE and comprehensive tutorials on all is products online. There are courses available under Microsoft Office Help & Training as well as Microsoft Office 365 Training for those who may be interested. Your local Unemployment Insurance office can guide you on the availability and use of other resources. Filing for unemployment benefits is a rather straightforward process. Keep in mind that these benefits are temporary and take advantage of this time when you’re receiving benefits to look for employment. About the authorMandy Fard is a Certified Professional Resume Writer (CPRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. 10 Sites for teleconferencing during the Coronavirus outbreak

10 Conference call resources to use to work remotely and to protect yourself from the coronavirus. Don’t let the coronavirus interrupt your job search or your career.

1. Appear.in

2. FreeConference.com 3. FreeConferenceCall.com 4. Google Hangouts 5. GoToMeeting.com 6. Join.me 7. Skype 8. UberConference 9. Webex 10. Zoom Brought to you by https://www.market-connections.net. About the authorMandy Fard is a Certified Professional Resume Writer (CPRW) and Recruiter with decades of experience in assisting jobseekers, working directly with employers in multiple industries, and writing proven-effective resumes . RESUME SERVICE PRICE LISTI have been writing resumes for a very long time and I have spoken to many people about their professional background and potential. Of ccurse, no two people are ever the same. What I have noticed is that when talking about resume writing services, EVERYONE has two questions at first:

From there, the following questions vary depending on each individual. But the first two questions have always remained the same. Please take about ONE MINUTE to conveniently watch this detailed video for precise answers to your question. Resume Writing Services Pricing and ProcessONE-MINUTE VIDEO If watching a video is not convenient, you will find the same information in a SLIDESHOW by clicking here.

AuthorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. Hire a Resume Writer

A Resume Writer uses the right keywords, has the best ATS resume checker, applies the latest formatting strategies for speedreading, enhances your content, and helps your resume stand out from the crowd.

A Resume Writer is often a freelance writer who specializes as a technical writer and focuses on resume writing and other career-related documents. Hire Resume WriterEmployment Law 101When applying for a job, what most candidates say they want is a level playing field — the opportunity to be considered for employment because of their skills, experience, and education, without consideration of how they look, what they wear for religious reasons, or how old they are. In other words, they want a hiring environment free of discrimination. Employment Law GuideThere are a number of local, state, and federal laws that employers must follow when hiring employees. Generally speaking, these laws prohibit discrimination in employment based on race, color, religion, sex, age, ethnicity/national origin, disability, or veteran status. With so many government agencies involved in creating laws for hiring and employment, it’s no wonder companies get confused. In some instances, these may affect you, the job seeker, as you may face potential discrimination in the application and/or hiring process. There are laws to govern how many hours you can work (Fair Labor Standards Act), the type of work you can perform in certain industries (Migrant and Seasonal Agricultural Worker Protection Act, for example), and even the types of benefits some types of companies can offer (Employee Retirement Income Security Act). This guide, however, is designed to familiarize you specifically with laws relating to applying for jobs, interviewing, and getting hired. Note: The information in this guide is not intended to provide legal, medical, or financial advice. If legal, medical, or financial advice is needed, an appropriate professional should be consulted. You are most likely to encounter these situations in smaller companies, where the owner or hiring managers handle applications, interviews, and job offers directly; however, discrimination occurs in companies of all sizes. Here is an analysis of some of the most relevant laws for jobseekers. Immigration and Nationality Act of 1952The Immigration and Nationality Act (INA) addresses employment eligibility, employment verification, and nondiscrimination in hiring. Under this law, employers may only hire candidates who are legally eligible to work in the U.S. (i.e., citizens and U.S. nationals) and aliens authorized to work in the U.S. Employers must verify the identity and employment eligibility of anyone hired, including completing an Employment Eligibility Verification Form (I-9 form) for each applicant. These forms must be kept on file for at least three years, or one year after employment ends, whichever is longer. Newly-hired employees must complete and sign the top section of the form (which collects biographical data) no later than the first day of employment. However, Section 1 should never be completed before you accept a job offer. Employers must complete Section 2 of the I-9 form within three business days of your first day of employment. Candidates will present documents to verify their identity, choosing from a list of acceptable documents outlined on the form. The identification establishes your identity and employment authorization. The INA protects U.S. citizens and aliens authorized to accept employment in the U.S. from discrimination in hiring or discharge on the basis of national origin and citizenship status. Another section of the act applies to employers seeking to hire nonimmigrant aliens as workers in specialty occupations, often referred to as “H1-B workers.” This is more common in the engineering, teaching, technology, and medical professions. The number of new H1-B visas that can be issued each year is subject to a cap. Relevance to Job seekers:You will be asked for documentation to complete an I-9 form at the time of hiring. You can review the I-9 form here: http://www.uscis.gov/files/form/i-9.pdf.

The Civil Rights Act of 1964Title VII of the Civil Rights Act of 1964 protects applicants from discrimination in hiring. Protection is granted on the basis of the applicant’s race, color, religion, sex (including pregnancy), and national origin. Religious discrimination includes an employer failing to provide reasonable accommodations for an employee’s religious practices if the accommodation does not create an undue hardship for the employer. Age Discrimination in Employment ActThe Age Discrimination in Employment Act of 1967 (ADEA) protects jobseekers who are 40 years of age (or older) from age discrimination in hiring. However, it is not illegal for an employer to favor an older job applicant over a younger one, even if both workers are age 40 or older. The law also forbids harassment because of age; for example, offensive remarks or repeated jokes about a person’s age. The ADEA applies to employers with 20 or more employees, including state and local government entities. Relevance to Job seekers:The ADEA generally makes it unlawful to include age preferences, limitations, or specifications in job notices or ads. A job notice or ad may specify an age limit only in the rare circumstances where age is shown to be a “bona fide occupational qualification” (BFOQ) — for example, airline pilots must retire at age 65 in the U.S.

The Rehabilitation Act of 1973Section 503 of the Rehabilitation Act of 1973 (as amended), is very similar to the Americans With Disabilities Act (ADA). It requires certain employers (including those with federal contracts or subcontracts) to take affirmative action to hire, retain, and promote qualified individuals with disabilities. Covered disabilities include a wide range of mental and/or physical impairments that “substantially limit or restrict a major life activity,” such as hearing, seeing, speaking, walking, breathing, performing manual tasks, caring for oneself, learning, or working. In addition, individuals who have recovered from their disabilities may not be discriminated against because of their past medical history. Relevance to Job seekers:The law only protects against discrimination for disabilities. You must possess the necessary education, skills, or other job-related requirements to be considered for the position. You must also be able to perform the essential functions of the job — the fundamental job duties of the position you desire — with or without reasonable accommodation (which require the employer to make adjustments or modifications in the work, job application process, work environment, job structure, equipment, employment practices, or the way that job duties are performed so that an individual can perform the essential functions of the job.)

Pregnancy Discrimination ActIn 1978, Congress amended Title VII of the Civil Rights Act of 1964 to enact the Pregnancy Discrimination Act (PDA). This law forbids discrimination based on pregnancy when it comes to any aspect of employment, including hiring. If a woman is temporarily unable to perform her job due to a medical condition related to pregnancy or childbirth, the employer or other covered organization must treat her the same way it treats any other temporarily disabled employee. For example, the employer may have to provide light duty assignments, disability leave, or unpaid leave to pregnant employees, if it does so for other temporarily disabled employees. Relevance to Job seekers:You do not have to disclose your pregnancy to a prospective employer when applying for a position. However, you may not want to change jobs during pregnancy if your health care coverage would be affected by a new position. If the new employer offers health care coverage, there may be a waiting period before coverage begins. However, insurance coverage for a pregnancy generally cannot be denied within a group insurance plan. The Health Portability and Accountability Act of 1996 (HIPAA) ensures that group health insurance plans cover pregnancy, in most cases. However, if your new employer does not offer a health insurance benefit, you may find it difficult to obtain an individual policy that covers your pregnancy-related claims.

Immigration Reform and Control ActIn compliance with the Immigration Reform and Control Act, discrimination on the basis of national origin involves treating applicants unfavorably because they are from a particular country or part of the world, because of ethnicity or accent, or because they appear to be of a certain ethnic background (even if they are not). National origin discrimination can also extend to treating candidates unfavorably because they are married to (or associated with) a person of a certain national origin, or because of their connection with an ethnic organization or group. The Immigration Reform and Control Act of 1986 (IRCA) makes it illegal for an employer to discriminate with respect to recruitment and hiring based on an individual’s citizenship or immigration status. The law prohibits employers from hiring only U.S. citizens or lawful permanent residents unless required to do so by law, regulation, or government contract. Employers may not refuse to accept lawful documentation that establishes the employment eligibility of an employee, or demand additional documentation beyond what is legally required, when verifying employment eligibility, based on the employee’s national origin or citizen status. Relevance to Job seekers:Discrimination on the basis of national origin may begin with your initial application to the company. An employer may be reluctant to call an applicant whose name he or she cannot pronounce, so providing a nickname on the résumé or job application may help.

For example, if you wear a hijab for religious or cultural reasons, an employer may be worried about how the company’s customers would react to it. However, customer preference is never a justification for a discriminatory practice. The employer is not likely to articulate that as the reason why you were not selected for the position. Even though you might feel that was the reason you were not hired, a fuller explanation of the employer’s business reasons would be needed to determine whether or not discrimination was involved. Americans With Disabilities Act of 1990Title I of the Americans With Disabilities Act of 1990 (ADA) protects qualified individuals from discrimination in hiring on the basis of disability. Covered employers must make reasonable accommodations for known physical and/or mental limitations of an otherwise qualified individual (unless it creates an “undue hardship” on the employer). The term “qualified” means that you have the skills, experience, education, and other job-related requirements of the position being sought, and can perform the essential job functions of the position, with or without reasonable accommodation. Not all employers are required to comply with the ADA. Covered organizations include private employers with 15 or more employees, employment agencies, and labor organizations. State and local government employers must also comply with the ADA. Accommodations are considered “any modification or adjustment to a job or work environment that enables a qualified person with a disability to apply for or perform a job.” It also includes alterations to ensure a qualified individual with a disability has rights and privileges in employment equal to those of employees without disabilities. Relevance to Job seekers:When applying for a position, the prospective employer may not ask you to answer medical questions or take a medical exam before extending a job offer. You may not be asked if you have a disability (or about the nature of an obvious disability). You can be asked, however, whether you can perform the job and how you would perform the job, with or without a reasonable accommodation. (After you are offered the job, an employer can make the job offer contingent on passing a required medical examination, but only if all candidates for that job category have to take the examination.)

From a practical standpoint, you should not request an accommodation during the application process unless there is a workplace barrier that prevents you, due to a disability, from competing for a job or performing the job. Likewise, you should not reference your medical history when applying for a position (for example, to account for a gap on your résumé or explain a job change on your cover letter) unless absolutely necessary — or if it is relevant to the position you are seeking. The only limitation on an employer’s obligation to provide reasonable accommodations is that no change or modification is required if it would cause “undue hardship” to the employer — meaning significant expense or difficulty in making the accommodation (for example, if the modification would be disruptive, or if it would fundamentally alter the nature or operation of the business).

Genetic Information Nondiscrimination Act One of the newer candidate protection regulations is the Genetic Information Nondiscrimination Act of 2008 (GINA), which protects applicants from discrimination in hiring based on genetic information. GINA restricts employers’ acquisition of genetic information and strictly limits disclosure of genetic information, including information about genetic tests the applicant may have received, the manifestation of diseases or disorders in applicant’s family members, and requests for receipt of genetic services. GINA was enacted, in large part, because of developments in the field of genetics, the decoding of the human genome, and advances in the field of genomic medicine. Genetic tests now exist that can determine whether individuals are at risk for specific diseases or disorders. The law addresses the concerns of individuals who fear the loss of health coverage or employment because of their genetic information. Relevance to Job seekers:

Special Consideration for Veterans in HiringCertain companies with federal government contracts or subcontracts are required to provide affirmative action to employ

For more information, visit http://www.dol.gov/vets/. How to work with a Resume Writer“Resume Writing Services: Everything You Need To Know”When you make the decision to hire a professional resume writer, you’re not only investing your time and money, but you're also entrusting me to articulate your personal brand and shape how you'll position yourself in your job search. I take this responsibility very seriously, and am providing these 10 tips to help ensure we have a successful, positive collaboration! 1. Communicate clearly

2. Be clear on your career plans and objectives

3. Meet your deadlines

4. Invest in yourselfYour new résumé is just one tool in your job search toolbox. If I suggest you purchase a new outfit for your interview, or I recommend additional services to complement your résumé, consider the request carefully. Your income is your number one asset, and as the saying goes, “sometimes you need to spend money to make money.” Spending 1-3% of your annual income on improving your career prospects is a wise investment. 5. Trust me, I'm your Résumé WriterPlease don't solicit opinions about your résumé from your friends or family members. You hired me for my expertise. So, if you have any questions, don't be afraid to ask me. Related to this: Don't believe everything you read on the Internet. For every article that talks about why your résumé should be one page, there are more which say it should be two pages (and not longer). 6. Remember, your résumé is a marketing document, not a biography.I'm not going to include every detail about your life and work history on your résumé, especially if you have certain jobs that aren't relevant to your career target. These details are important to who you are, but they are not necessarily important in this résumé for this job target. I will be selective in what information I include because your résumé tells a story about who you are and what you can do. 7. Don't “lend” your résumé to anyone else.Your new résumé is a customized document developed just for you. Allowing someone else to use your résumé (format, design, and/or wording) may even dilute its effectiveness for you — especially if you "lend it" to a co-worker or colleague. If someone admires your résumé, send him or her my way and I will create an equally awesome document customized for their job search! 8. If you're not getting results, let's talk.We might need to make some changes to make your résumé more effective, or I might be able to share some strategies to help you increase the number of interviews and job offers you receive. 9. Let me know how you're doing.Sometimes I don't hear from clients until they need an update to their résumé when it's time to look for a new job. But I want to hear from you when you get a job offer. We'll celebrate together! 10. Keep your résumé updated.Speaking of your new job, once you land a new position (and you're sure you're going to stay -- usually, after the first 90 days), get back in touch with me to add your new position. Keep an accomplishments journal so you can track your achievements in your new role, which makes it easier to respond to new opportunities that come up. I look forward to working with you. We can start here! Things to keep in mind Your job search success

Your resume won't necessarily look like the samples on my website

Don't just use your new resume to apply for jobs online, please!

Provide the information you want on your resume up front

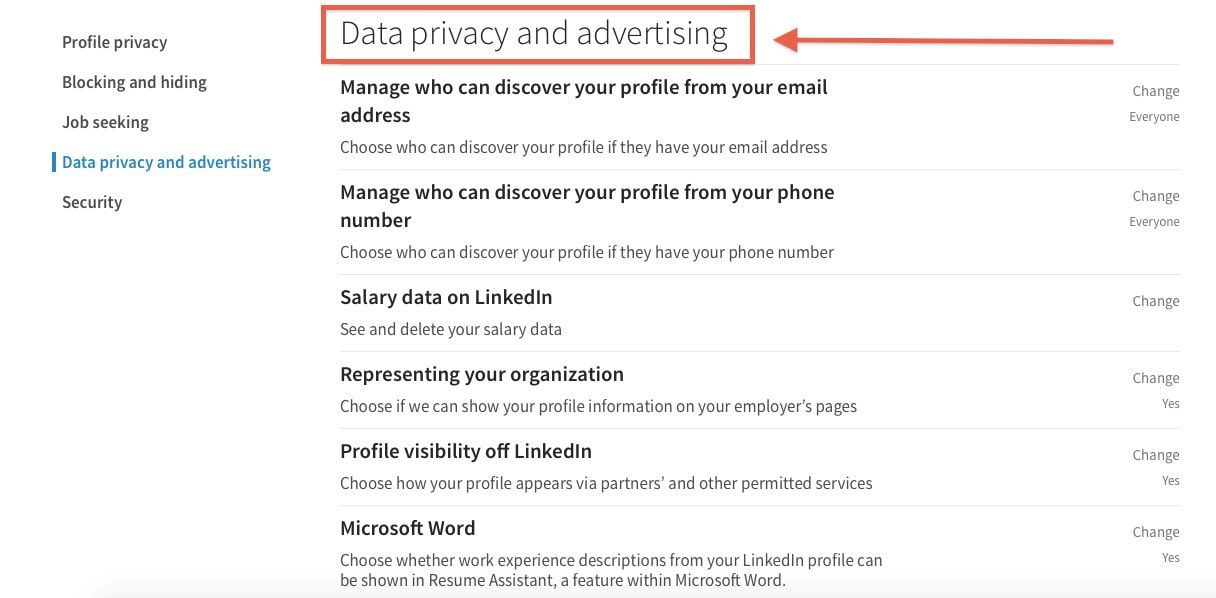

Upload resume to LinkedInHow to protect your info on LinkedInNormally, when you are setting up your LinkedIn privacy settings, you’re selecting the audience you want to be able to see your LinkedIn profile. But there is one new LinkedIn setting that you will want to select to ensure that LinkedIn doesn’t share your content. When Microsoft purchased LinkedIn in 2016, the integration of the social media platform with Microsoft’s products was alluded to in the announcement. In an internal memo published on TechCrunch.com, LinkedIn CEO Jeff Weiner identified some specific areas where the two companies would work together. These included:

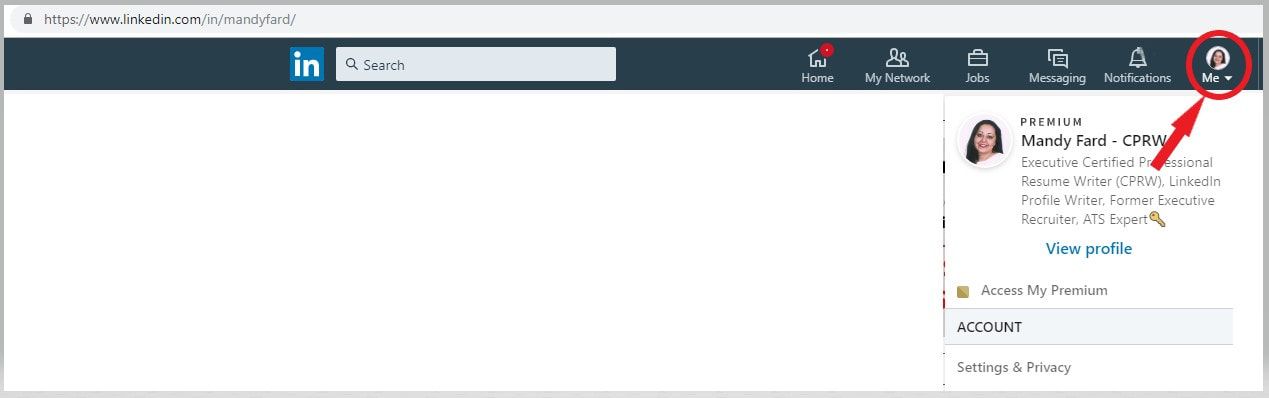

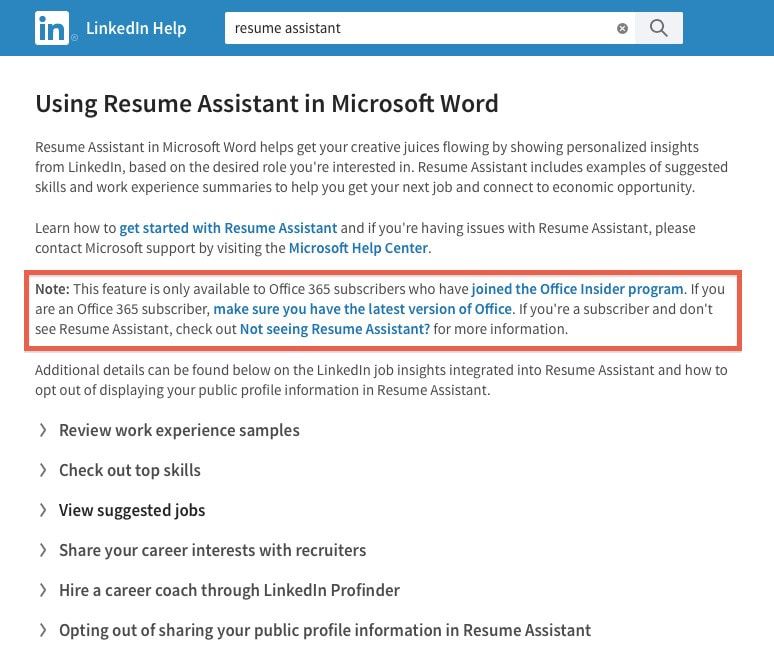

With the announcement of a new Microsoft Word feature called “Resume Assistant,” that integration is becoming even more apparent. When this feature is enabled, it shows what other people in similar roles say about themselves in their LinkedIn profiles, allowing users of the word processing software to incorporate that content directly into the résumé they are creating for themselves. While it has always been possible to view profiles of individuals in similar roles for inspiration when constructing your résumé, LinkedIn Headline, and profile content, this new feature allows users to directly copy content from other peoples’ LinkedIn profiles. And, in fact, it is encouraged by Microsoft/LinkedIn. Fortunately, with the introduction of this new feature, LinkedIn has also recently added a new privacy setting to allow you to omit your LinkedIn profile from showing up in Microsoft Word’s Resume Assistant. Disabling the sharing function makes it harder for others to “plagiarize” your LinkedIn content — whether you wrote it yourself, or had assistance from a professional résumé writer. One of the best things you can do to keep your content from being plagiarized is to make it uniquely about you and branding yourself so distinctively that your content couldn’t possibly be used to describe anyone else but you! Step 01: Click “Me” on Your LinkedIn Profile

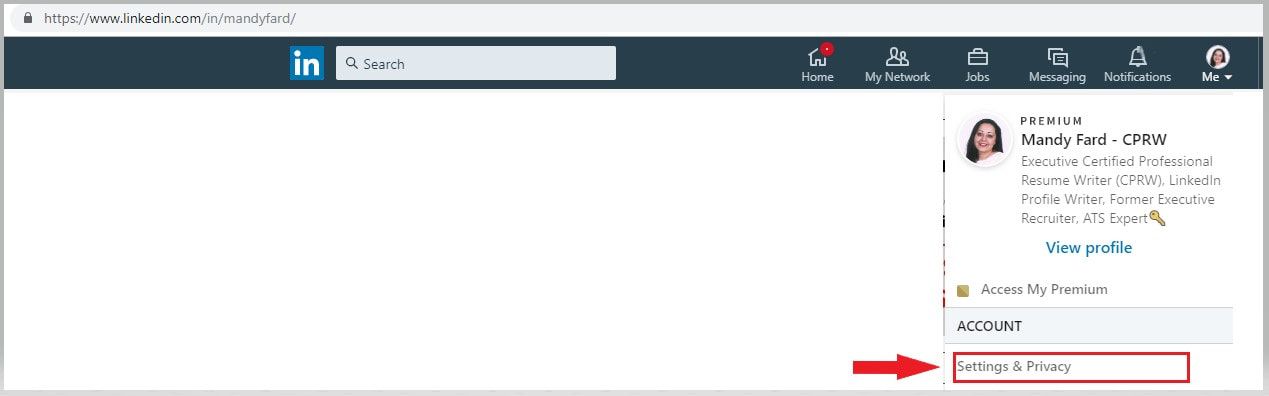

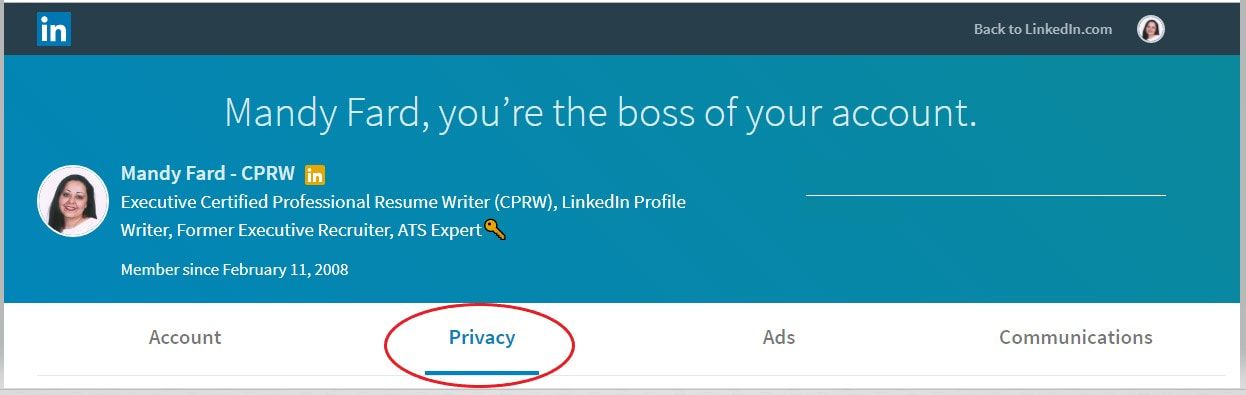

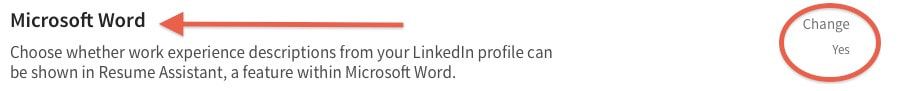

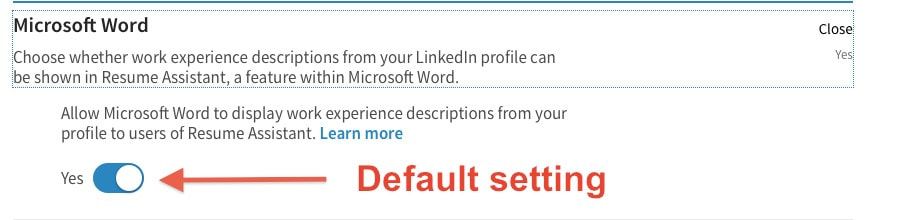

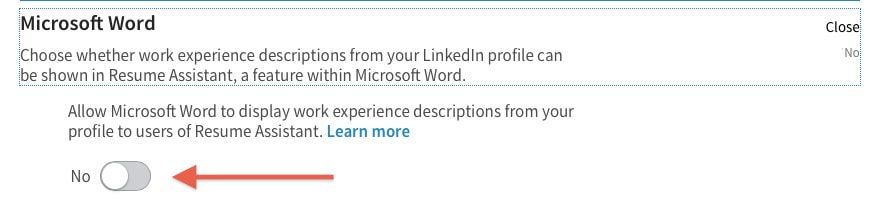

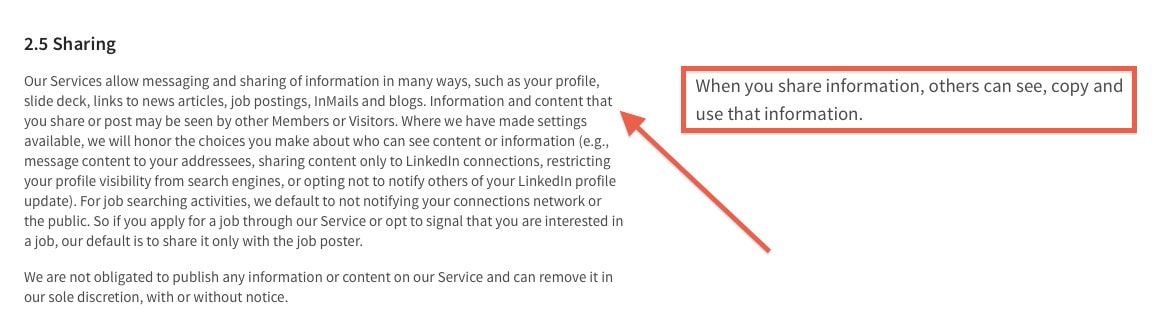

Step 02: Find “Settings & Privacy”Click “Settings & Privacy.” Step 03: Click “Privacy”Step 04: Scroll Down to “Data Privacy and Advertising” SectionStep 05: Click on Microsoft WordThe default setting is “Yes” — “Allow Microsoft Word to display work experience descriptions from your profile to users of Resume Assistant.” Step 06: Slide From the Default “Yes” to “No”Changing the setting to “No” keeps LinkedIn from sharing your descriptions with Microsoft Word users. Step 07: Resume Assistant IntegrationHere is LinkedIn’s explanation of the Resume Assistant integration. Note: Even though you have disabled the sharing of your content with the Resume Assistant, LinkedIn’s Privacy Policy and Terms of Service explicitly warn users that the information that you share can be seen, copied, and used by other members. One of the best things you can do to keep your content from being plagiarized is to make it uniquely about you — branding yourself so distinctively that your content couldn’t possibly be used to describe anyone else but you! Step 08: Changing This Setting in the LinkedIn Mobile AppYou can also change this setting in the LinkedIn mobile app.

In the app, go to the “Settings” gear in the upper right-hand corner and click “Privacy.” Scroll down to “Microsoft Word” and display the setting. Change the slider to “No.” Resume Assistant is a new feature that is only available to Office 365 subscribers who are part of the “Office Insider” program. Resume Assistant pulls suggested skills and work experience descriptions from LinkedIn profiles when the Resume Assistant setting is set to “Yes.” |

Categories

All

powered by Surfing Waves

AuthorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. Archives

July 2024

|

-

Greater Los Angeles

and Kern County

-

[email protected]

.

RSS Feed

RSS Feed