What are the "best practices" to manage teams remotely?How to remotely manage your team

Here is an infographic to help you review the 10 best practices to manage your team from home and keep everything in perspective. Much like enything else, there is a right way and a wrong way to do everything.

About the authorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. 8 Tips To Stay Motivated While Working From Home

First define motivation for yourself. You would be surprised at the different meanings that are offered online. A good place to start is a look at motivation synonym offered by Thesaurus. You will also see a and

Self motivation strategies for working from home

When you work in an office, your day might already be planned out with your coworkers giving you social interaction and your boss giving you accountability. Sometimes, the interruptions are significantly higher and/or of a more urgent nature; i.e.: if you work in property management or in healthcare, etc.

However, working from home is much different. How can you get work done without any of this help that you would normally receive from coworkers? Try these techniques to stay motivated and be productive:

Working from home isn’t for everyone, but if you love the freedom of making your own schedule, then you may love it. Follow these tips and you’ll be able to stay motivated, maintain discipline, and get all of your work done while working from home. About the authorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. Solutions for the suddenly unemployedSurviving Sudden Unemployment

Through no fault of your own, you find yourself suddenly out of a job. Now what?

The first question to answer is: Is this unemployment temporary — or permanent? If you’re out of work due to the Coronavirus pandemic, your employer may have furloughed you temporarily. If that’s the case, your efforts will be focused on getting through this temporary period of unemployment. If, however, your employer has permanently closed, or if you’re looking to change jobs or change careers, you’ll have different actions to focus on. Your first step: Secure your finances

Regardless of whether the unemployment is temporary or permanent, your first step is to assess your financial situation. This includes both your personal finances as well as identifying any benefits due to you, either from your company or government sources.

Personal Finances

One of the biggest mistakes many people make after losing their job is not making immediate adjustments in their finances. With the uncertainty of the full impact of the Coronavirus pandemic, you could be out of work for four weeks, or four months. No one knows right now.

However, if you were already living paycheck-to-paycheck, there will likely be some impact on your finances. So the first thing you should do is adjust your lifestyle to fit your new financial reality … at least temporarily. Conserve as much cash as you can. Make a list of your current expenses (review your checkbook register, credit card statements, and/or online banking profile) and see what you can cut out. Determine which of your current monthly expenses must be maintained (mortgage and car payments, utilities, groceries) and which ones you can do without for now. The sooner you make these adjustments, the better off you will be. Once you know what you’ll have to live on (unemployment benefits and savings, for example), you can determine if you need to find other sources of income — for example, a part-time job. (This income may have an impact on your unemployment benefits, but you may need the money to carry you though until your unemployment compensation comes in, which could be 2-4 weeks or longer.) If your unemployment stretches on for a while, you may need to cut back to only making minimum payments on your bills. While now is not the time to be holding a garage sale, you may find some things that you can sell for cash on Facebook Marketplace, buy/sell/trade groups, or Craigslist. (Be sure to minimize contact with buyers — for example, taking payment by PayPal, Facebook payments, or Venmo and doing porch pickup.) Try to avoid tapping into your retirement accounts or selling stocks or mutual funds while the stock market is down. If you have a cash-value life insurance policy, you might consider tapping it for emergency cash, but remember you will have to pay interest on any loans you take out, and you’ll want to pay the loan back when you are able to. If you will have trouble making your mortgage payment or paying other bills (credit cards, auto loans, student loans), contact your lender. Many of them have forbearance programs which allow you to make reduced payments or skip payments (adding the missed payments to the end of the loan period). You may also be eligible for special programs for the unemployed. For example, the “Home Affordable Unemployment Program” may reduce your mortgage payments or suspend them altogether for a period of time. Your credit card company may reduce your interest rate or lower your required minimum payment due to a job loss. (If you have involuntary unemployment credit card insurance, your credit card company may cover the minimum payment if you are laid off for a specific period of time. However, charges incurred after the layoff are excluded.) Don’t wait to explore your eligibility for these programs. Company Resources

When you were furloughed, your company may have provided information about the benefits you have access to. If your company is continuing to pay part or all of your salary while you’re at home, that should be specified in the information you were given. Likewise, if you are not being paid, you may be able to access accrued vacation or sick pay. If you have company-provided healthcare, find out if your company will continue to pay your premiums while you are unemployed. (Otherwise, you will need to secure temporary health care coverage.)

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) eased restrictions for accessing retirement account funds. The new law allows workers who are financially impacted by the Coronavirus pandemic to cash out up to $100,000 of their 401(k) or IRA accounts. (Affected individuals are people who are diagnosed with COVID-19, their spouse or dependent. In addition, undiagnosed individuals can take a Coronavirus Related Distribution (CRD) if they suffered adverse financial consequences due to being quarantined, furloughed, laid off, having their hours reduced, or who were unable to work due to child care responsibilities due to the Coronavirus pandemic.) The law waives the 10 percent early withdrawal penalties (if money is taken out before age 59-1/2) and gives qualifying individuals three years to replace what they took out or to pay the ordinary income taxes due on the distribution. However, cashing money out of your retirement account is not recommended unless it’s a last resort, as you will be sacrificing long-term growth of this money. If you are furloughed from your job, you may not have to immediately repay any outstanding 401(k) loans like you would if you lost your job. (If you leave your job under normal circumstances — whether by choice or if your position ends up being terminated, if you are under 55, unless you repay the loan in full by tax day the following year, that loan becomes a distribution and you will pay a 10 percent early withdrawal penalty plus your ordinary income tax rate on that money.) Note: If you had a previous loan against your 401(k), the CARES Act legislation does not apply to that loan. Government Benefits

If you were furloughed from your job, look into filing for unemployment benefits immediately.

The unemployment insurance system (UI) is a partnership of the federal government and state programs. Created in 1935, contributions are paid into the system on behalf of workers so they have an income if they lose their jobs. The basic UI program is managed by the states, although the U.S. Department of Labor oversees the system. States provide most of the funding and administer the benefit payments. Although states must follow federal requirements, they generally establish their own eligibility criteria and benefit levels. Check and see if your state offers an unemployment benefits calculator. (A simple Google search can identify if one is available.) There are two types of unemployment calculators — one that tells you how much money you are entitled to collect, and another which tells you how many weeks you are eligible to collect unemployment. You must meet eligibility requirements, but you can determine these from your state’s unemployment office. You may even be eligible for benefits (even partial benefits) if you work part-time. You may also be eligible to collect unemployment benefits while you are collecting other benefits from your current position. Getting paid for unused vacation time you accrued normally does not affect your eligibility. However, you will not be eligible for benefits if you continue to receive your full salary and benefits your employer paid while you were employed. Regular unemployment insurance benefits — in most states — run for 26 weeks (plus one unpaid “waiting week”). For people who have not yet found a job within that time frame, Emergency Unemployment Compensation (EUC) and Extended Benefits (EB) offer additional compensation. Each of these programs has a different deadline. Consequently, the number of weeks you are eligible for will depend on when you filed your original claim. Your unemployment payment depends on your weekly earnings prior to being laid off, and the maximum amount of unemployment benefits available (this will vary by state). Unemployment benefits typically replace about half of your previous earnings, subject to a maximum benefit level. According to the Center on Budget and Policy Priorities, the average unemployment benefits nationwide was $387 per week in February 2020. The maximum state-provided weekly benefit ranges from $215 in Mississippi to $550 in Massachusetts. (Some states offer higher benefits to jobseekers with dependents. Check your state benefit details to see if this is the case in your state.) Because the benefit is subject to a cap, unemployment insurance benefits replace a smaller share of previous earnings for higher-wage workers than for lower-wage workers. The permanent Extended Benefits (EB) program typically provides an additional 13 or 20 weeks of compensation to the unemployed who have exhausted their regular benefits in states where the unemployment situation has worsened dramatically. You may also qualify for unemployment benefits from the impact of the COVID-19 pandemic if:

You may not be eligible if you quit your job because you are worried about contracting Coronavirus at work. Check with your state’s unemployment office before quitting your job. Each state’s guidelines vary. For example, in the state of Nebraska, you may still be eligible to collect unemployment benefits if you quit your job but have “good cause” for quitting — for reasons including (but not limited to), the conditions of work, compelling health reasons, or quitting to escape spousal abuse. Note: If you stayed home from your job because you were worried about contracting Coronavirus, you may not be eligible for unemployment compensation. The CARES Act excludes individuals who have the ability to work from home with pay from collecting unemployment. It also excludes those who are currently receiving paid or sick leave. The CARES Act also provides supplemental unemployment compensation. The law provides emergency funding to states to provide an additional $600 a week in payments — on top of regular weekly payments, as long as the individual is eligible to receive at least $1 of underlying benefits for the claimed week — from the time a worker lost his or her job until July 31 as part of the Federal Pandemic Unemployment Compensation (FPUC) benefits. It also funds an additional 13 weeks of unemployment benefits for states, which typically cap unemployment benefits at anywhere between 12 and 30 weeks. File your claim for benefits as soon as you are able to. Note that you will have to request benefits every week you want a payment, even if your application is still pending initial approval. File your claim weekly during your furlough. Many states have a one-week “waiting period” before claims are eligible. (Georgia, Iowa, Maryland, Michigan, Nevada, New Jersey, Vermont, and Wyoming don’t have a “waiting week.”) At least 35 other states have waived the waiting period for Coronavirus-related unemployment claims, allowing eligibility for benefits immediately. In addition, at least 27 states have waived the requirement that workers actively search for work in order to be eligible for unemployment compensation. Although many claims are paid within a few business days, it may take 2-3 weeks for your first unemployment check to arrive (and these days, most claims are paid electronically through direct deposit to your account or to a reloadable prepaid debit card, instead of a physical check). Under normal circumstances, unemployment insurance program provides benefits to people who: • have enough employment to establish a claim • have lost employment through no fault of their own • Are ready, willing, and able to work • Are actively seeking work However, as mentioned previously, the requirements to actively seek work have been waived in many states. For the “actively seeking work” requirement, if you are unable to work due to the Coronavirus pandemic, as long as you stay in contact with your employer, and are available to return to work when asked, you satisfy the “work search, availability, and capability” requirements. If your current unemployment is not due to the Coronavirus pandemic, you still need to conduct a weekly work search; however, you do not need to accept work offered to you if you are under quarantine or if you have been instructed to stay at home (or are under a statewide stay-at-home order). One thing you may not have realized is that unemployment benefits count as taxable income on your federal tax return. Unemployment compensation may or may not be taxable in your state. Check with the Department of Labor in your state for information. Most state unemployment applications allow you to choose to have state and/or federal income tax withheld from your payments. Make sure you set aside part of the money for taxes if taxes are not withheld from your payment. You may be required to make quarterly estimated tax payments if you do not have taxes withheld from your unemployment benefit payments. Check with your tax advisor for advice. Other Assistance

Your new financial situation may make you eligible for other kinds of assistance. For example, the Supplemental Nutrition Assistance Program (SNAP), or “food stamps” are issued by the state based on financial need. Each state has a different application form and process, so contact your state agency directly to apply. During the current public health emergency, some of the existing regulations are being relaxed or suspended, which will make additional people eligible for this benefit.

Health Care Coverage

If your company is not paying your health care premiums while you are unemployed, if your company has more than 20 employees, you can continue your existing health care coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA) law. However, you will need to pay this premium yourself. The cost of the COBRA premium may be higher than short-term insurance you can obtain for yourself.

If you have a health condition, you will want to ensure continuous coverage, so don’t let your group plan lapse before you get short-term insurance coverage in place. You may also want to check with your employer’s human resources department to be sure you will be able to get back on the group plan when work resumes. If COBRA premiums are too costly, you can also look into short-term health insurance coverage. One source of options is ehealthinsurance.com. You may also be able to take advantage of private coverage thorough enrollment on an Affordable Care Act (ACA) health care exchange. If you had insurance through your employer that is no longer available, you may be eligible to enroll on the individual exchanges as part of a Special Enrollment Period. Check your eligibility and options available on Healthcare.gov or your state’s health insurance marketplace. Depending on your income, you may also qualify for free or low-cost coverage under Medicaid. (The Healthcare.gov site provides information about this option as well.) Step 2: Is it time for a change?

If It’s Time for a Change

You may also take this opportunity to change directions with your career. Because the provisions under the CARES Act do not require those receiving unemployment benefits to be actively seeking work, you could use this time to start a new business. In 2012, the Middle Class Tax Relief and Job Act authorized $35 million in funds to encourage states to enhance and promote Self-Employment Assistance (SEA) programs. SEA entitles unemployed individuals to claim jobless benefits while simultaneously gaining access to small business development assistance. An individual with a “viable” business plan can continue to receive unemployment benefits as long as they are working full-time to get a new company off the ground. Under this program, individuals receive financial aid equal to their unemployment insurance benefits for a maximum of 26 weeks while they receive entrepreneurial training and other resources (including counseling and technical assistance) to help them launch a business. However, note that you are not eligible to receive extended unemployment benefits if you participate in the SEA program — you are limited to 26 weeks of payments, and you may not be eligible to receive the additional $600/week in federal assistance. Check with your state’s Department of Labor to see if they offer a SEA program. (As of March 2020, the states of Delaware, Mississippi, New Hampshire, New York and Oregon have active Self-Employment Assistance programs.) Take advantage of the programs available to you. Many of these are paid for through state and federal funds. This isn’t charity. These are programs paid by tax dollars, and the goal is to get you back working again. Step 3: What To Do Now

Without a job to go to every day, your days may seem endless. (Unless you have children at home that you’re suddenly in charge of teaching.) Work on projects that you’ve put off because you’ve been busy with work. Learn how to use your hobby to your advantage, discover your passion, revive your personal network, and most importantly, don't waste your time.

Think about where you want your career to be one year from now, and five years from now. Take the opportunity to move yourself closer to these goals. Use your successes and failurs to your advantage. Focus on personal development. Are there skills you can work on developing? There are opportunities to take online classes for free. For example, the eight Ivy League universities are offering hundreds of online courses to the public at no charge. Many other course platforms are making courses available online for free or low cost. Check out: • ClassCentral.com • Coursera • edX • Rosetta Stone • Alison With many of the free courses, you can also secure a certification for an additional fee, which you can add to your résumé. Speaking of résumés, now is also an excellent time to work with your résumé writer to update your résumé, LinkedIn profile, and other career search documents. When you’re back to work and the economy is humming along again, you may find yourself wanting to look for a better job. Now might be the right opportunity to take the time to gather your accomplishments. Seek support from others during this time. In-person gatherings are highly discouraged, but you can use technology like FaceTime, Skype, and Zoom to meet up virtually with friends, family, and even co-workers. Be sure to take care of yourself during this time. Eat right. Try to get at least some exercise each day. Get plenty of sleep. Take advantage of the programs and services available to you, and be prepared for what’s next.

About the authorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. 10 Mistakes to avoid when managing remote teamsHow to manage your team remotely

Here is an infographic to help you review the mistakes to avoid when managing your team from home and keep everything in perspective. Much like enything else, there is a right way and a wrong way to do everything.

Recommended posts:

About the authorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. Tools to work remotelyProject ManagementCommunication and Screen SharingRemote AccessFile Management and SharingTime Tracking and Productivity MonitoringDesign CollaborationSharing Notes and IdeasMind Mapping and Visual BrainstormingCalendar SharingDistraction Blockers

StayFocusd

SelfControl (Mac) Serene (Mac) Cold Turkey Productivity Owl Scrivener (minimalist writing tool) Security and Password HygieneFeedback and RecognitionTime Zone CoordinationAbout the authorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. LinkedIn ScorecardHow to Evaluate and Score Your LinkedIn Profile

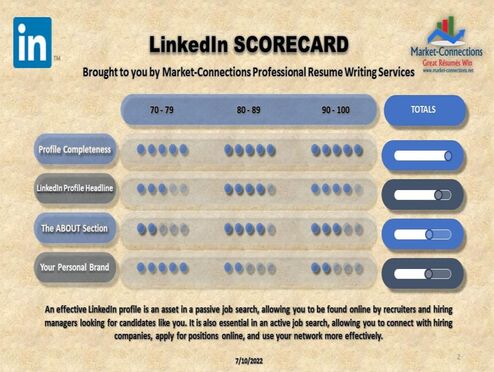

The LinkedIn Scorecard is a comprehensive self-assessment that allows you to evaluate the effectiveness of your LinkedIn profile according to LinkedIn’s best practices in the following areas:

An effective LinkedIn profile is an asset in a passive job search, allowing you to be found online by recruiters and hiring managers looking for candidates like you. It is also essential in an active job search, allowing you to connect with hiring companies, apply for positions online, and use your network more effectively. Give yourself the appropriate number of points for each line. Then total your score. LinkedIn Profile Completeness

Profiles that are considered “complete” by LinkedIn’s standards receive 40 times more “opportunities” (contacts from prospective hiring mangers and recruiters) than incomplete profiles. LinkedIn has its own criteria for “profile completeness” — these are things you need to have on your LinkedIn account in order to have a “complete profile", according to LinkedIn.

Not listed on your profile = 0

On profile = 4

RECOMMENDATION: Including your industry is one of the items required for profile completeness.

Not listed on your profile = 0

On profile = 4

RECOMMENDATION: Including your location is one of the items required for profile completeness.

No current position on profile = 0

Simple listing (job title/company) = 2 Complete listing with description = 4

RECOMMENDATION: An updated current position is one of the items required for profile completeness.

No past position = 0

1 past position with simple listing = 1 2 past positions with simple listings = 2 1 past positions with complete listing = 3 2 past positions with complete listings = 4

RECOMMENDATION: Including two past positions under Experience is one of the items required for profile completeness.

No current education on profile = 0

Complete listing (institution and degree) = 4

RECOMMENDATION: Including details about your education is one of the items required for profile completeness.

Not on profile = 0

Minimum of three listed = 4

RECOMMENDATION: Including a minimum of three Skills is one of the items required for profile completeness.

Not on profile = 0

Have a profile photo = 4

RECOMMENDATION: Including a profile photo is one of the items required for profile completeness.

Fewer than 50 connections = 0

50 or more connections = 4

RECOMMENDATION: The more connections you have, the wider your network.

LinkedIn Profile Photo

LinkedIn profiles with photos get 21 times more views and 36 times more messages. Is your LinkedIn profile photo giving the right impression?

Older than 2 years = 0 points

Within the last 24 months = 1 point Within the last 18 months = 2 points Within the last year = 3 points

RECOMMENDATION: Having a profile photo is important. Keeping it up to date is also important.

Yes = 2 points

No = 0 points

RECOMMENDATION: Make sure your photo is appropriate for a business profile.

RECOMMENDATION: Your face should be clearly recognizable in your profile photo.

Yes = 0 points

No = 2 points

RECOMMENDATION: Including a relevant background photo can enhance your personal brand.

Yes = 2 points

No = 0 points

RECOMMENDATION: Photo should be high resolution.

LinkedIn Headline

Your LinkedIn Headline is one of the first things someone sees when they search for you. It is very importan to have a good LinkedIn Headline.

Only name and/or credentials = 0 points

More than your name and/or credentials = 2 points

RECOMMENDATION: Don’t include more information in your Headline than LinkedIn allows (name and credentials are allowed).

Yes = 2 points

No = 0 points

RECOMMENDATION: Don’t just use the default LinkedIn Headline. Make sure it speaks to your uniqueness. Write a good LinkedIn headline.

Yes = 2 points

No = 0 points

RECOMMENDATION: Maximize your impact — use all the characters to your best advantage.

Yes = 2 points

No = 0 points

RECOMMENDATION: Help yourself be found by recruiters and hiring managers. Use relevant keywords in your Headline.

LinkedIn Profile Basics

No volunteer work = 0 point

At least one volunteer position = 1 point Multiple volunteer position listed = 2 points

RECOMMENDATION: Including volunteer experience not only populates another LinkedIn section, but it also shows how well-rounded you are.

No Projects listed = 0 point

At least one Project listed = 1 point Multiple Projects listed = 2 points

RECOMMENDATION: Including Projects not only populates another LinkedIn section, but also can demonstrate your proficiency in some of your Skill areas.

No Organizations listed = 0 point

At least one Organization listed = 1 point Multiple Organizations listed = 2 points

RECOMMENDATION: Including Organizations not only populates another LinkedIn section, but also can demonstrate your willingness to get involved in activities.

You have fewer than 5 Skills listed = 0 point

You have 5-24 Skills listed = 1 point You have at least 25 Skills listed = 2 points

RECOMMENDATION: Three Skills are necessary for profile completeness, but the more you include, the better your chances of being found. (Skills count as valuable keywords for search engine optimization.)

No personalized URL = 0 points

Personalized URL = 3 points

RECOMMENDATION: Personalizing your URL shows you know your way around LinkedIn (it’s a power user tip) and makes it easy to use your LinkedIn URL outside of LinkedIn.

None of the links renamed = 0 points

Some text links renamed = 1 point Most text links renamed = 2 points All text links renamed = 3 points

RECOMMENDATION: Renaming your links is a power user tip.

Many errors = 0 points

Several errors = 1 point Few errors = 2 points No errors = 3 points

RECOMMENDATION: Having an error-free profile is essential to making a good impression on recruiters and hiring managers.

Your Personal Brand on LinkedIn

For your LinkedIn profile to help you reach your personal and professional goals, you must be able to communicate what makes you exceptional and compelling. This is your personal brand.

Yes = 1 point

No = 0 points

RECOMMENDATION: Don’t include “everything” on your LinkedIn profile — only information that is needed to help a hiring manager or recruiter decide to contact you.

Yes = 1 point

No = 0 points

RECOMMENDATION: Does your profile help give a recruiter or hiring manager a good idea of who you are and how you can be an asset to your next employer?

Yes = 1 point

No = 0 points

RECOMMENDATION: Make sure you are including information that makes the case for your relevant qualifications.

The ABOUT Section

The LinkedIn ABOUT section is your opportunity to tell your story — briefly and succinctly.

Yes = 2 points

Somewhat = 1 point No = 0 points

RECOMMENDATION: Like with your LinkedIn Headline, your ABOUT section should uniquely describe you.

Yes = 2 points

Somewhat = 1 point No = 0 points

RECOMMENDATION: The About section on LinkedIn should be a concise representation of who you are, and what you have to offer.

Yes = 2 points

Somewhat = 1 point No = 0 points

RECOMMENDATION: The About section should entice the reader to read more!

More than 100 words up to the max = 2 points

Between 40-100 words = 1 point No content or fewer than 40 words = 0 points

RECOMMENDATION: You have lots of characters/words to use in the Summary — make the most of them!

Common LinkedIn Profile Mistakes

Avoid making common LinkedIn mistakes on your profile.

Yes = 1 point

No = 0 points

RECOMMENDATION: Don’t try to be “all things to all people” — instead, focus your profile.

(An informal profile should be in first person [I, me].

a formal profile should be written in third person [Sharon, she or Tim, he]).

Yes = 1 point

No = 0 points

RECOMMENDATION: An informal profile should be in first person (I, me); a formal profile should be written in third person (Sharon, she or Tim, he)

(Make sure to include information in all relevant sections —

i.e., Honors & Awards, Languages, Certifications, Patents, Publications, etc.)

Yes = 1 point

No = 0 points

RECOMMENDATION: Make sure to include information in all relevant sections — i.e., Honors & Awards, Languages, Certifications, Patents, Publications, etc.

Ask for Recommendations; aim for one Recommendation for every 50-100 connections

Yes = 1 point

No = 0 points

RECOMMENDATION: Ask for Recommendations; aim for one Recommendation for every 50-100 connections.

Engaging on LinkedIn

Only about 40 percent of LinkedIn users log in daily. The average LinkedIn user accesses their account for 17 minutes per month. What you do while you’re on LinkedIn is important.

Add connections every time you log in = 4 points

Add connections weekly = 3 points Add connections monthly = 2 points Add connections only occasionally = 1 point Have not added any connections since joining = 0 points

RECOMMENDATION: Growing your network is one of the most powerful functions of LinkedIn. Continue to add connections to improve your network.

Log in at least twice a month = 2 points

Log in at least once a month = 1 point Log in less than once a month = 0 points

RECOMMENDATION: Accessing your LinkedIn account regularly is important.

Following at least 5 Company Pages = 2 points

Follow at least 1 Company Page = 1 point Don’t follow any Company Pages = 0 points

RECOMMENDATION: Company Pages can provide you with connections to your target employer as well as notifications of job openings.

Post three times a month or more = 3 points

Post twice a month or more = 2 points Post on your profile at least once a week = 1 point Post less than once a week = 0 points

RECOMMENDATION: Sharing content on your LinkedIn feed is one of the best things you can do to engage with your network of connections and increase your visibility on LinkedIn.

Post photos three times a month or more = 3 points

Post photos twice a month or more = 2 points Post photos at least once a week = 1 point Post photos less than once a week = 0 points

RECOMMENDATION: There’s that saying that a picture is worth a thousand words. Pictures are a great way to get engagement on your LinkedIn news feed.

Yes = 3 points

No = 0 points

RECOMMENDATION: Posting articles using LinkedIn Publishing is a great way to establish yourself as a thought leader.

SCORING

The content feed on LinkedIn gets 9 billion impressions per week, so this is a huge opportunity for engagement. However, only 1% of LinkedIn’s users share posts at least once a week. Only 0.2% of LinkedIn users have published an article using LinkedIn Publishing. Remember, posts with photos increase the comment rate by 98%.

90-100 Points Congratulations! You’ve positioned yourself to be found by recruiters and hiring managers and are on your way to building a strong network for your career goals. Keep up the good work! 80-89 Points Your profile is very strong, but there are some opportunities to improve it. Review the scorecard and see where you can raise your score. 70-79 Points You’ve got a good start, but you’re missing some key areas where your profile can help you attract career opportunities. Review your scorecard and shore up the areas where your scores were low. 60-69 Points Your profile isn’t as effective as it could be. Spend some time working on it and you’ll increase your career opportunities. Focus on making sure your profile is complete and spend some time engaging on LinkedIn. 59 Points or Below Help! Your profile needs attention. LinkedIn isn’t a “set it and forget it” platform. Invest some time in your profile.

About the authorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. Applying for unemployment benefitsA guide to apply for unemployment insurance

If you recently lost your job, you could qualify for unemployment benefits. Keep in mind that you cannot apply for unemployment benefits if you quit your job or were fired for negligence or misconduct. If this is the case and you feel you were fired unfairly, your best option is to contact a wrongful termination attorney.

Unemployment is meant to be a temporary form of assistance that replaces a part of the salary you’re no longer earning. These benefits are managed at state levels, but federal guidelines exist. The complete name of this program is the Federal-State Unemployment Insurance Program. Since these benefits are funded through taxes paid by employers to states, the amount of the benefits, requirements, and duration vary from one state to another. There are two main requirements you have to meet before filing: 1. You need to have worked for a specific time period. Most states require you to work for a full quarter before you become eligible for unemployment benefits. 2. You need to have lost the job through no fault of your own. These criteria vary from one state to another. It’s important to start filing for unemployment as quickly as possible, since you’ll have to wait a few weeks before you start receiving benefits. Some states actually require you to wait an entire week after losing your job before beginning the filing process.

Follow these steps to apply for unemployment benefits:

Most states will grant you unemployment benefits for 26 weeks. Your state can also provide you with valuable resources. You might be required to register through the State Employment Service to be matched with open positions in your area. If your state doesn’t require you to register through this service to receive benefits, it could help you to register anyway so you can be alerted about available positions. Other resources include testing, counseling, and training programs. These are options you should explore if you have a hard time with finding work in your field. There is a variety of tutorials and training content available online. For example, Microsoft Office offers FREE and comprehensive tutorials on all is products online. There are courses available under Microsoft Office Help & Training as well as Microsoft Office 365 Training for those who may be interested. Your local Unemployment Insurance office can guide you on the availability and use of other resources. Filing for unemployment benefits is a rather straightforward process. Keep in mind that these benefits are temporary and take advantage of this time when you’re receiving benefits to look for employment. About the authorMandy Fard is a Certified Professional Resume Writer (CPRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. HOW TO SELL YOURSELFLearn how to sell yourself in a job interview

Having presentation or interpersonal skills is not the same as knowing how to sell yourself in an interview. If you do not know how to sell yourself, you can’t help prospective employers. Plus, you may find it very challenging to receive employment offers and/or to negotiate your salary.

Change your thinking. The idea of using sales skills in an interview often brings up negative thoughts. The fact of the matter is that it is an essential interaction that is necessary for your success in securing new employment.

It’s ok to negotiate. Your expertise has a monetary value. There is a time and a place for negotiations, offers, and incentives. Make sure you don’t sell yourself short. You exchange your experience, training, knowledge and insight for monetary rewards. Think of your services as and yourself as a product available for purchase. Show the prospective employers why they need you. Learn how to interact with a potential employer, so that they realize you can help them. This means showing them, rather than telling them about your skills and knowledge. Having a professional portolio in hard copy or online, can demonstrate your skill set in a way that prospective employers come to their own conclusions about your capabilities. Keep in mind that you are selling a product. The combination of your experience, knowledge, and skillset is your product; your resume and your interactions demonstrate a taste of things to come. Believe in yourself. SELL yourself. Acknowledge your personal strengths and demonstrate them to prospective employers. Help them recognize your passion and interest in learning, helping, cooperating, and applying your skills. Once you believe that you are are adding value and are capable of delivering the goods, it shines through to others. About the authorMandy Fard is a Certified Professional Resume Writer (CPRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. When is the right time to change your job8 Reasons to change your job

If you work in an environment where people are regularly coming and going for a variety of reasons, it can be hard to pinpoint when it’s your time to leave. Are you being dramatic, or is it really time to pack up and find a new place to put down roots? You spend a lot of time at work, so you should be somewhere that works for you. Keep reading for 8 reasons that you should change your job.

1. You Aren’t Learning Continuing education is a fundamental part of life. Your work should be teaching you daily. About your job, the world, or really anything. If you aren’t learning new things at work, then it might be time to find a new job. It’s time to leave your comfort zone. 2. You Don’t Feel Satisfied with Your Contributions No longer feeling like you are contributing or making worthwhile contributions at work can leave you feeling unworthy or, like your position in the company doesn’t matter. Seek out a work environment that you can contribute to. No need to feel trapped in your circumstances. 3. You Aren’t Enjoying Your Work Every day isn’t going to be a cakewalk, but you should still generally enjoy your work and the people that you work with. Feuding coworkers don’t help the situation either.. 4. You Don’t Feel Valued You should feel valued by your company, supervisor, and coworkers. That is a basic human necessity that you deserve. 5. You Have Negative Feelings Regularly If the “Sunday Scaries” is a nightly occurrence, and your drive to work is rife with distress, considering looking for a job that at least brings platonic emotions. 6. Your Health is Suffering If your work is negatively affecting your physical and/or mental health, then take that as a clear and loud sign that you need to go elsewhere. You can’t work if you’re dead, and everyone can be replaced. 7. You’ve Topped Out Look around your office. If there is nowhere else to go and you have reached your plateau, then it is time to look for a position that will either be a move up or will allow for more advancement. 8. Your Environment is Toxic Overbearing taskmasters, constant turmoil, and lack of a work/life balance are clear signs that you are working in a toxic environment. However, many other forms of toxic work environments are not as easily picked out. Think carefully about what you want out of your work culture and what you are actually getting. Sometimes it is evident when you need to find a new job. However, for many, it can be a series of small and seemingly minuscule events and feelings that lead to finding new work. Think about your work life and personal life, and consider if a change is in need. About the authorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. |

Categories

All

powered by Surfing Waves

AuthorMandy Fard is a Certified Professional Resume Writer (CPRW, CMRW) and Recruiter with decades of experience in assisting job seekers, working directly with employers in multiple industries, and writing proven-effective resumes. Archives

July 2024

|

-

Greater Los Angeles

and Kern County

-

[email protected]

.

RSS Feed

RSS Feed